Here's the Challenge

Banks, insurance companies, and other financial services firms operate in heavily regulated, often global environments. Protecting Personally Identifiable Information (PII), credit card information (PCI), and intellectual property can be challenging – especially when trying to keep up with new, emerging requirements at the local and global levels.

Security teams need solutions that solve such compliance challenges, offer flexibility to grow with their needs over time, and prioritize end-to-end security for their data protection use cases.

Here's the Solution

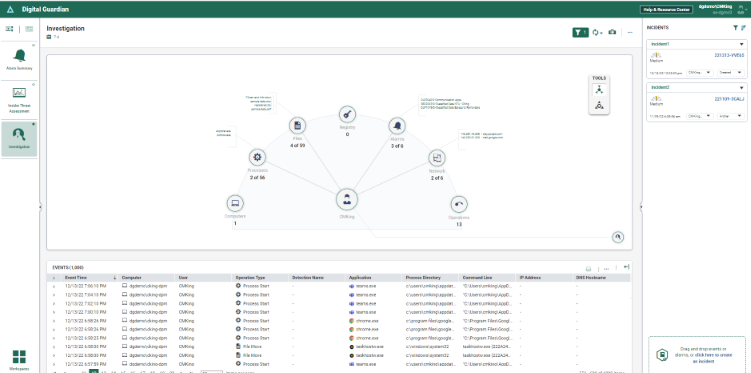

Leading financial services firms, from global insurance and banking institutions to regional credit unions, trust Fortra's Digital Guardian to safeguard their sensitive data. Digital Guardian enables financial firms to offer innovative digital user experiences while still achieving data privacy compliance.

Digital Guardian's enterprise-wide data protection platform provides flexible controls, real-time analytics, and interoperability to protect your organization's intellectual property and customers' personal information against insider and outsider threats.

Digital Guardian will protect your sensitive data wherever it lives or is shared—across networks, storage, endpoints, or in the cloud—and Digital Guardian Secure Collaboration will ensure such sensitive data can be shared securely with third parties as well. And since you may have data on Windows, Mac, and Linux machines, you need a solution that protects them all. Digital Guardian's cross-platform coverage delivers for you.

Benefits of DLP

Improve Your Organization’s Security Posture

Comply With Key Regulatory Requirements

With the ability to compile a detailed audit trail, Digital Guardian can demonstrate compliance with current privacy regulations—such as the EU GDPR, SOX, and GLBA—and provides the flexibility to meet future needs as regulatory requirements change. Our DLP platform will help financial services organizations protect:

BANKING DATA

- Personally Identifiable Information (PII)

- Payment Card Industry Data Security Standard (PCI DSS)

FINANCIAL MARKET DATA

- Personally Identifiable Information (PII)

- Payment Card Industry Data Security Standard (PCI DSS)

- Intellectual Property (IP): Deal Management Information, Trading Algorithms, Financial Modeling, IPO Plans, M&A Plans

INSURANCE DATA

- Protected Health Information (PHI)

- Personally Identifiable Information (PII)

- Payment Card Industry Data Security Standard (PCI DSS)

INTELLECTUAL PROPERTY (IP)

- Deal Management Information

- Trading Algorithms

- Financial Modeling

- IPO Plans

- M&A Plans

Why Top Financial Services Firms Choose Digital Guardian

Identify, Track, and Share Your Sensitive Data With Confidence

Digital Guardian's DLP platform will protect your sensitive data wherever it lives or moves and provides cross-platform coverage, meaning that data will experience the same protection across Windows, Mac, and Linux machines.

Moreover, Digital Guardian Secure Collaboration will ensure such sensitive data can be shared securely both internally and with external partners and customers. Digital Guardian Secure Collaboration helps financial services securely share:

Our Customers’ Success Speaks for Itself

New England Federal Credit Union (NEFCU) lacked enterprise-wide visibility and granularity into sensitive, regulated data movement, but needed to maintain compliance standards and their competitive advantage. With over 88,000 members and $1 billion in assets, NEFCU controls all egress channels with Digital Guardian DLP.

Once Digital Guardian Network DLP was installed, visibility into our network traffic was significantly improved. We could see exactly what data was being transmitted and where. Today I can’t imagine doing security work without it.

Michael Stridsberg, Information Security Program Manager, NEFCU

Schedule a Demo

Ready to see our DLP platform in action? See how Digital Guardian can help protect your critical data wherever it lives.