Here's the Challenge

Insurance companies rely on both regulated data such as client details and intellectual property including actuarial tables to serve their customers. Both have value to attackers, whether internal or external to the firm.

Security teams at these firms must balance the compliance risks of emerging solutions with customer demands for innovative, digital experiences.

Here's the Solution

Leading insurance firms from across the globe trust Digital Guardian to safeguard their sensitive data. Digital Guardian enables data privacy compliance while securing the innovative digital experiences today’s customers demand.

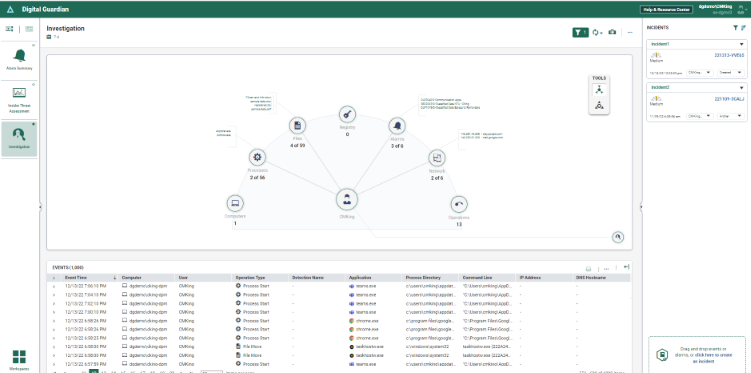

Digital Guardian's enterprise wide data protection platform provides the deepest visibility, real-time analytics, and flexible controls to protect client account information and your intellectual property against insider and outsider threats.

Your sensitive data is protected, wherever it lives or is shared – across networks, storage, endpoints, or in the cloud. And since you may have data on Windows, Mac, and Linux machines, you need a solution that protects them all. Digital Guardian delivers for you.

Solution Benefits

One of the big assets for me is that as soon as we had an agent pushed out, within a couple of hours, I was able to see what my risk footprint is as far as what data is where…not even acting on any of the data at all; it was knowing what was where and where the biggest risk is. That's pretty incredible.

VP Information Security Insurance Services Firm

Selected by Leaders in the Cyberinsurance Industry to Reduce Cyber Risk

Digital Guardian answers the question: “What cybersecurity products does our insurer value most from a risk underwriting perspective?"